Chuck Kawakami’s Eye and Short Comments

Update:2022/7/20

2022/7/20

Chuck Kawakami’s Eye #16:Is the dollar reserve currency system sustainable?

Please click the upper link

2022/5/1

Chuck Kawakami’s Short Comment :

The dollar’s upward momentum will gradually weaken.

20220501The dollar’s upward momentum will gradually weaken

2022/4/24

Chuck Kawakami’s Eye #15: Turning Point of “Inflation Rhapsody” Chuck Kawakami’s Eye #15

Please click the upper link

2022/4/17 short comment

The U.S. economy, which has been somewhat overheated, is showing signs of beginning to slow down, partly due to the demand suppression effect of inflation.

The U.S. Consumer Price Index, which came out last week, showed a very high 8.5% year over year for the total, including food and energy, from 7.9% in the previous month, and the rate of increase is further expanding. This is not surprising, especially since both energy and food prices were greatly affected by Russia’s invasion of Ukraine in March. On the other hand, the Consumer Price Index excluding food and energy was 6.5%, while the rate of increase was almost unchanged at 6.4% in the previous month, and the month-on-month annual rate of increase slowed from 6.2% in February to 3.9% in March. This indicates that price increases except those caused by the war are beginning to slow.

On the corporate side, there are signs of a slowdown in profit growth among listed companies, as evidenced by the slowdown in the PMI: ‘s 12-month forward earnings per share forecast of the S&P 500 and NASDAQ 100, in index-based point terms, were 226 and 570 points at the end of March and 224 and 559 points as of April 15 respectively. It suggests the turning point for corporate earnings which have expanded at a steady pace since the worst of the Corona Shock at the end of June 2020.

The consensus of economists’ forecasts for the U.S. economy’s growth rate this year, which was 3.4% in the February survey, has now been lowered to 3.0%, indicating a downward revision to the expansion of the U.S. economy.

The U.S. yields affected raising global interest rates, but inflation expectations are expected to gradually change as well.

2022/4/3 Short Comment

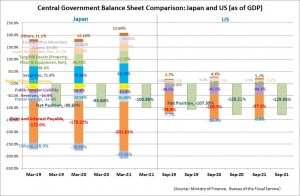

Net debt comparison between the Central Governments of US and Japan

It is often said about Japan that the national debt is quite large. This is also one of the factors that contribute to selling yen in the foreign exchange market.

However, what is often discussed about the national debt is the size of the gross amount. In fact, the Japanese government also holds more national assets than any other country in the world. For this reason, it is necessary to look at Japan’s balance sheet in reality.

Focusing on the dollar-yen, which is of most interest on the Japanese side, I would like to look at the reality by comparing the balance sheets of the central governments; U.S. and Japan.

Looking at Japan’s balance sheet on the asset side, it holds financial assets such as securities as public pension assets and loans, and tangible fixed assets, which is equivalent in size to 209% of GDP. In contrast, the debt, including government bonds and public pension liabilities, is 310% of GDP. Subtract liabilities from assets, is a net debt of 101% as of GDP. This is what can be seen in the consolidated financial statements of Japanese central government at the end of the previous fiscal year, which is announced at the end of each fiscal year, i.e., at the end of March 2021 in the case of this year’s announcement. This is a summary of the nation’s overall financial position as a consolidated account of the general and special accounts.

On the other hand, the balance sheet of the U.S. federal government is also published. The latest one is as of the end of September 2021. According to this, assets are equivalent to 21% of the U.S. GDP, debt is 151% of GDP, and net debt is about 130% of GDP.

Although the reference period is six months different, we can see that the net debt of the U.S. federal government is larger as a percentage of GDP. This means that as far as the central government debt situation is concerned, the situation is becoming more severe in the U.S. than in Japan. In this sense, the actual content of national debt does not necessarily lead to yen depreciation bias against the dollar. At the very least, this situation does not mean that the government debt factor has been factored into the market’s move toward current dollar strength.

On the other hand, the BIS data shows that the gross debt of the global non-financial sector (households, non-financial corporations, and governments), is close to 300% of global GDP which financial markets have been largely ignoring this debt factor. With the bottoming out of global interest rates becoming clear, sooner or later the markets will focus on debt factors. It is important to remember to watch this transition closely as well.

2022/3/21 Chuck Kawakami’s Eye (#14)

JPY depreciation will not last longer

Chick Kawakami’s Eye #14 20220321 <link for PDF file with graphs>

2022/3/13 Chuck Kawakami’s Eye (#13)

High Oil Prices will not last so long

Chuck Kawakami’s Eye #13 <link for PDF file with graphs>

2022/3/6 Short Comment : Needed Change in Japanese managements

Employment in the U.S. remained strong through February, with the unemployment rate at 3.8%, which is close to full employment for the U.S. society. Digital innovation has led to an increase in the number of new businesses and an increase in the number of jobs.

On the other hand, the recently released Corporate Statistics of Japan by MOF shows different shape. The net assets of Japanese companies, the capital portion of companies, totaled approximately 786 trillion yen at the end of December 2021, nearly 1.5 times the GDP, while the number of employees peaked at 36.6 million in March 2008, and the employment level has moved over the past 10 years between 31.6 million and 34.5 million. At the end of December 2021, the number was 33 million.

In terms of asset efficiency, the highest in the early 1980s, the turnover ratio, which is sales divided by total assets, was 1.5 times, but the current ratio is 0.75 times, half of the peak, and has deteriorated considerably. Due to data limitations, assuming that recurred profit and depreciation are combined as gross cash flow, the investment to gross cash flow ratio is currently 36%, which exceeded 100% during the aftermath of the investment boom immediately after the bubble economy, but it has been dropping steadily and money is not being spent on investment.

If the overall situation of Japanese companies, which are lagging considerably behind in innovation, cannot get out of this shrinking trend, employment will not increase either. I would like to see further progress in management reform in Japanese companies. Reform of management is also very important. If reform does not progress within Japanese corporate organizations, I would like to see activists, M&A funds, and others take further influence.

2022/2/27 Short Comment on Situation in Ukraine

I would like to express my heartfelt condolences to the victims of Russia’s invasion of Ukraine and pray for a quick end to the battle.

In Ukraine, both the U.S. and NATO have decided not to intervene militarily against Russia, which has invaded the country, so the result of the Russian invasion is now a fait accompli, and the situation is likely to come together relatively quickly. The market is seeing this as a move that could be said to have factored in the worst case scenario before the battle.

For example, the price of oil, which is most affected by the Ukraine crisis, has moved as follows.

When the Washington Post reported the possibility of a large-scale Russian invasion on December 3, 2021, the price of crude oil on a WTI basis was in the high $60s per barrel.

On January 24, 2022, when the U.S. Embassy in Ukraine was ordered to evacuate its staff and their families, the price was in the low $80s.

On February 14, the day of the announcement of the temporary relocation of the U.S. Embassy from the capital city of Kiev, the price was at $95 per barrel, and on February 25, the second day of fighting, it closed at the $92 level.

If we were to assume a battle involving NATO and other countries, the price would easily exceed the $100 level, but at present, the scenario of an escalation of the battle through further participation can be interpreted as a minority in the market. I would like to see the market move toward a real settlement of the situation. For Japan, the war is far away, but the economic impact on Japan, which imports resources, is also significant. Furthermore, changing the status quo by force is directly related to the Taiwan and Senkaku Islands issues. It is very dangerous to think of it as something else.

2022/2/20

Japan’s GDP for 4th quarter in 2021 was released last week. In real terms, i.e. after subtracting price changes, the GDP is expected to increase by 0.7% y-o-y. However, the situation is a completely different when you look at the nominal figures that include prices. The nominal GDP is -0.6% y-o-y. The positive and negative directions are reversed.

The main reason for this is the rise in commodity prices, including energy and grains. Japan imports a lot of energy such as oil and natural gas, for example, so even if the volume of imports does not change significantly, a sharp rise in the price of energy and other commodities will have a significant impact on nominal GDP.

Net exports contributed 0.2% to real GDP in the October-December period compared to the previous year. In quantitative terms, this means that the economy is flat. In nominal terms, however, the rise in the price of resources has contributed the nominal GDP by -2.3%. Of course, nominal GDP is also affected by the recent depreciation of the JPY. In short, the high prices of resources and food products and the weak yen have increased Japan’s payments to foreign countries.

Under the Abe administration, the yen has been weakened through “inter-dimensional monetary easing” and other measures, but looking at the current situation, there is no doubt that we have reached a turning point as seen above. The government has increased spending on subsidies, but public fixed capital formation such as public works is negative, and the total impact on GDP is not positive by the government. It seems that a change in policy is necessary if we are to raise the income of the households. I look forward to the Kishida cabinet’s wise decision in the future.

2022/2/13

I would like to talk about the economic situation in the United States, which is currently the world’s fastest growing economy.

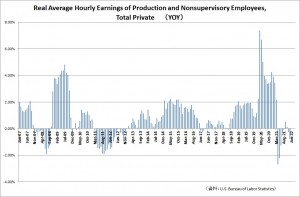

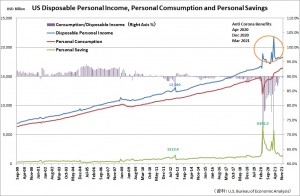

First of all, inflation is high. For example, consumer prices rose 7.48% in January y-o-y. In parallel, hourly wages in the private sector and non-managerial workers rose 7.61% in January, so real wages after subtracting prices rose 0.13%, almost flat. In Japan, real wages, which are cash salaries and exclude prices, declined by 2.2% y-o-y. In fact, in the U.S., real wages per hour in the private and non-farm sectors declined by 1.53% y-o-y in 4th quarter 2022.

In the U.S., rising prices have also had an impact on wage trends, but it is also true that legislation to raise the minimum wage, which was enacted in rapid succession in each state at the end of the Obama administration, is still alive and pushing up wages. For example, in California, the minimum wage will increase from $9 per hour in 2015 to $15 per hour in 2022, a 7.1% increase from $14 last year to $15 this year. However, whether or not the wage hike will match the actual situation of companies is another matter, as labor productivity in the October-December period grew only about 2% from the previous year, making a higher wage increase burdensome. The Biden administration has announced that it wants to raise the minimum wage, which varies considerably from state to state, to $15 in all states by 2025, but the Congressional Budget Office has pointed out that if this continues, companies will not be able to bear the cost and more than 1.4 million jobs will be lost.

In this sense, the U.S. economy is currently out of balance in terms of inflation and wages. We need to pay close attention to how this will be controlled in the future.

2022/2/6 short comment

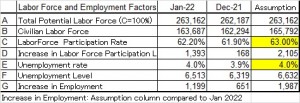

The U.S. employment situation for January was revealed late last week, and as of January, the situation remains very strong.

The unemployment rate was 4%, up from 3.9% in the previous month, but this was due to a sharp increase in the number of job seekers as a result of the employment situation. The number of job seekers increased by 1,393 thousand in the last month, which was absorbed by hiring 1,119 thousand people in all industries. It is also unusual for the total number of employees in all industries, including agriculture, to exceed one million.

On the other hand, hourly wages for non-managerial workers rose 6.9% in January y-o-y, but consumer prices rose 7.0% in December y-o-y, which is almost the same level as the rise in prices. As far as we can see from the data, real wages have been negative recently, since April of last year. With the end of government benefits to individuals, this real wage situation is expected to weaken consumption gradually. Savings, which temporarily increased due to benefits, have also returned to 2019 levels. It is time to consider that it is going to be difficult for the US economy to sustain its current strength. The U.S. economy, which has been leading the world economy, is showing signs of peak-out in some indicators. The cyclical turn is more likely than the expectation of the markets.

2022/1/30 short comment

The price of crude oil is rising. This, in turn, pushes up the demand for grains, through rising prices of the raw material for biofuels. thus raising the international prices of energy and food products in general will remain the upward pressure on prices worldwide.

On the other hand, in Japan, where wages have not risen, the rise in consumer prices has managed to be contained. This is because the increase in purchasing power associated with higher wages is not on a process that pushes up prices.

Looking at the situation of prices, the preliminary figures of the CPI for the Tokyo metropolitan area for January show that the overall CPI rose by 0.6 percent year-on-year, while the CPI excluding food and energy was minus 1.2 percent. Among these, energy prices rose by about 20% year on year, and food prices as a whole rose by 2.1% year on year, but fresh food prices rose by a high 8.5%. In the U.S., price increases and wage increases are generally parallel, but in Japan they are not, so the rise in food and energy prices is slowly hurting households, isn’t it?

Technological progress makes it unlikely that there will be significant inflation, but if wages do not rise more than the price movement, the economy will deteriorate. Isn’t it time for Japanese companies to invest more aggressively, especially in their human resources, rather than just being stingy in hoarding profits? At the very least, I would like to see wages rise faster than the rise in prices of basic living materials.

Chuck Kawakami’s Eye

Oct 2021